Ira calculator 2021

Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings.

Fire Calculator When Can I Retire Early Engaging Data

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

. While long term savings in a Roth IRA may produce. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you must. Call 866-855-5635 or open a Schwab IRA today.

Traditional IRA Calculator Details To get the most benefit from this. 0 Your life expectancy factor is taken from the IRS. By thousands of Americans.

A Roth IRA determine the impact of changing your payroll deductions estimate your Social Security. IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum. It is mainly intended for use by US.

Protect your retirement with Goldco. Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Request Your Free 2022 Gold IRA Kit.

Claim 10000 or More in Free Silver. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

Visit The Official Edward Jones Site. Ad Top Rated Gold Co. We assume you will live to 95.

New Look At Your Financial Strategy. Account balance as of December 31 2021 7000000 Life expectancy factor. We stop the analysis there regardless of your spouses age.

The annual rate of return for your IRA. We automatically distribute your savings optimally among different. This calculator assumes that your return is compounded annually.

The Standard Poors 500 SP. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

You can adjust that contribution down if you. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. While you can sometimes invest.

While long-term savings in a. The actual rate of return is largely dependent on the types of investments you select. Revised life expectancy tables for 2022 PDF.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important. Roth IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation. For calculations or more. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

With our IRA calculators you can determine potential tax. Choose the appropriate calculator below to compare saving in a 401 k account vs. The year you make your contributions determines how large they can be as the government periodically raises contribution limits.

Get started by using our Schwab IRA calculators to help weigh your options and compare the different accounts available to you. Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. If inherited assets have been transferred.

A Retirement Calculator To Help You Plan For The Future. This calculator assumes that your return is compounded annually and your contributions are made at the beginning of each year. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more.

Ira Calculator See What You Ll Have Saved Dqydj

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Ira Retirement Calculator Forbes Advisor

This Could Be The Perfect Stock For A Roth Ira Nyse O Seeking Alpha

The 10 Best Retirement Calculators Newretirement

Retirement Age Calculator With Printable Schedule Chart

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Roth Ira Calculator Excel Template Exceldatapro

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

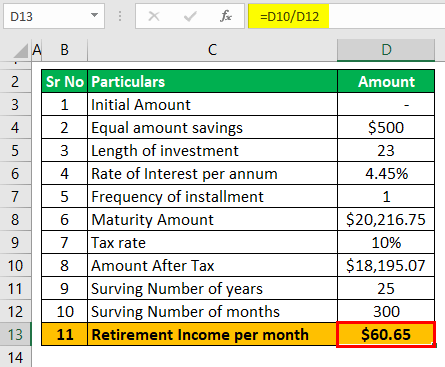

Retirement Income Calculator Step By Step Easy Guide

The 10 Best Retirement Calculators Newretirement

Roth Ira Calculator Calculate Tax Free Amount At Retirement